As a sixth-grade math teacher, I’m always on the lookout for ways to motivate my students. And one of the best ways I’ve found to do that is to connect what we’re learning to finance and money. My students are at the age when their wants, like PlayStations and Frappuccinos, are starting to play a bigger role in their lives. I’ve found that when my students understand how the math concepts they’re learning connect to their real lives, they’re much more engaged.

Three years ago, I started using a fantastic free digital resource, Vault—Understanding Money. Vault by EVERFI is a game-based financial education program that is a perfect fit with our math curriculum and has helped my students start to understand the many ways they’re going to use math when they grow up—no matter what path they choose. Here are my favorite reasons for using Vault with my math students.

Talking about money brings my math curriculum alive

So many of the math concepts my sixth graders are learning can be related to the ways we handle money. For example, when we talk about decimals, what better way to make the concept tangible for students than dollars and cents? And when we move on to absolute zero and negative numbers, we can talk about balancing a bank account and creating a budget. When we tackle percentages, we can practice by looking at sales prices when we shop. There are so many natural connections between math concepts and financial literacy that give students a solid grounding in real-life skills.

Kids love it

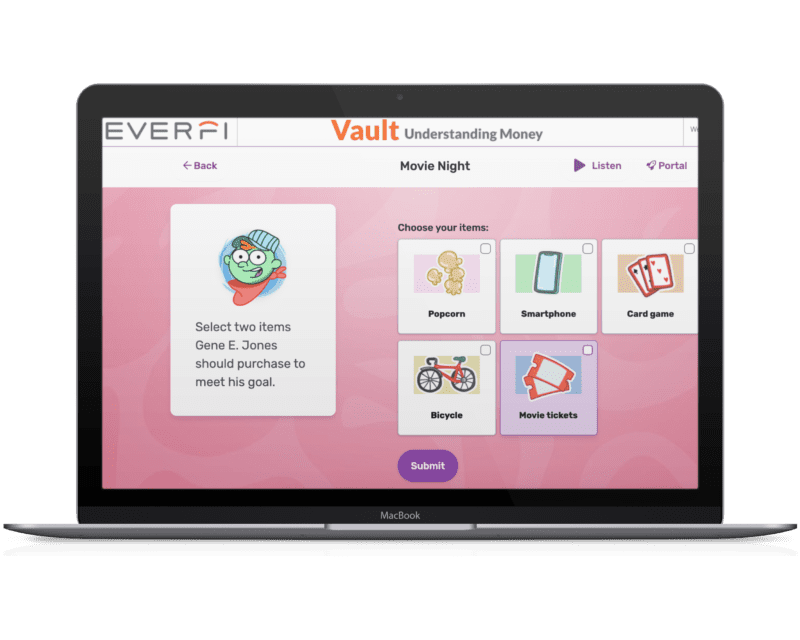

Vault makes learning feel like play for my students. The game begins with a group of kids playing their favorite card game, World Jumpers. The scene begins to spin out of control, and the group flies through a portal to a series of unlocked universes. Students must progress through each universe (each a different financial literacy topic) to make it to the end of the game.

My kids love it! They don’t necessarily think of it as work; they think they’re just playing video games. But, I know they’re getting something really valuable that I can weave back into my math instruction. Once we start discussing the scenarios they’ve encountered, it starts clicking: “Oh, this is why math is important, this is how you spend money, this is why we have to budget.”

Vault is easy to use for teachers

The great thing about Vault is that it is such a time saver for teachers. The lessons and activities are prepped and ready to go with everything kids need. And there are so many different ways to use it—as a whole class activity, in centers, as a two-week focus unit, etc. Best of all, Vault provides me with valuable feedback about how my students are doing—which blocks they’ve completed and how much of the material they’ve mastered—which helps inform my instruction.

It’s a perfect fit for hybrid and virtual learning

Trying to juggle everything during remote learning has been wild, to say the least. It’s hard to teach a full class from home without my dry erase board or Promethean board. Vault has been a great way to supplement learning for my math students. They can choose which section to work on and work at their own pace, which takes some of the pressure off of at-home learning. If they only have fifteen minutes to work on it based on their workload, they can do that. Plus, it’s fun and engaging and gives them a fun break from face-to-face instruction. Vault makes learning at home not such a drag and something my students look forward to.

Vault expands my students’ understanding

In sixth-grade math, we have so much to cover. Unfortunately, I don’t always have time to dive into financial literacy skills the way I would like to. Most of the time, we learn something, apply it to a couple of real-world problems, and then move on—because that’s just the way it goes.

Kids need a way to practice and integrate math concepts in ways that are meaningful for them. That’s why I love Vault. It gives kids time to explore topics like saving and spending, budgeting, investing and borrowing, and planning for the future in a really fun and engaging way. Best of all, it sets the foundation for making good financial decisions based on their values combined with mathematical thinking.

Interested in learning more about how Vault can help you teach money skills? Check out their free curriculum here.