I can remember sitting in the backseat of our family car and listening to my dad telling me that if I started saving now, I could be a millionaire someday. It’s all about compound interest. The sooner kids start saving for the future, the better. To introduce them to the concept, try this grade 6-8 “Saving for the Future” lesson. It’s all part of our Adventures in Math resource center!

What’s in the “Saving for the Future” lesson?

This lesson is divided into three parts:

Part 1—Engaging the Learner: Kick off with some starter questions like “What reasons do people have for saving money rather than spending it immediately?”

Part 2—Activity: Simple Interest vs. Compound Interest: In this section, you’ll be covering important vocabulary, such as principal, simple interest, compound interest, and approximate interest. You’ll also demonstrate the effects of interest using paper clips.

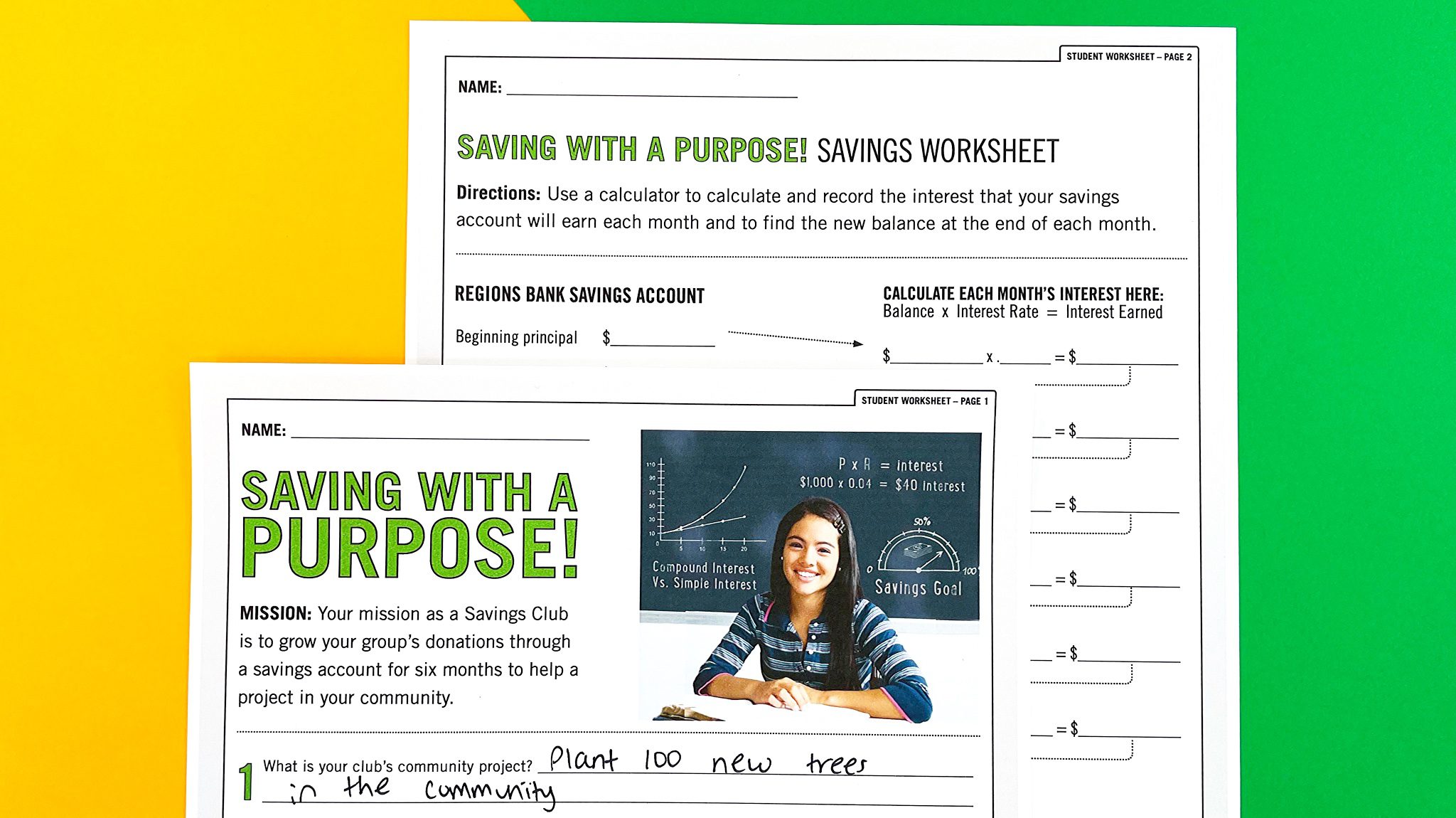

Part 3—Activity: Savings Club: Play a simulation game that brings students together into “saving clubs” to pool their money so they can help fund new equipment for a local playground, ballpark, or recreation center.

Standards

- Develop an understanding of personal financial literacy, including budgeting, spending, saving, and charitable giving.

- Develop an economic way of thinking and problem-solving as a consumer and investor.

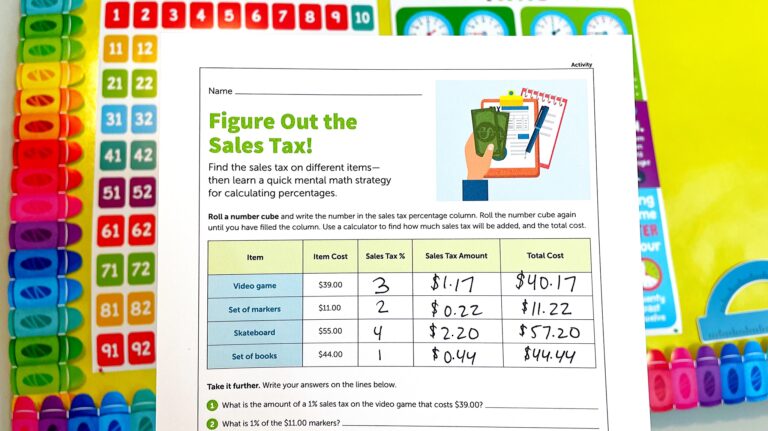

- Solve problems using the four operations with whole numbers and decimals to hundredths.

- Use positive and negative numbers to represent quantities in real-world contexts.

- Use proportional relationships to solve multi-step ratio and percent problems.

- Solve problems involving ratios, rates, and percentages, including multi-step problems that use percent increase and percent decrease, and financial literacy problems.

- Calculate and compare simple interest and compound interest earnings.