Learning how to save money is a hard lesson for most of us, so you might as well start talking about it early. This “Smart Saving” lesson for grades 3-8 does a great job of teaching kids about saving money in an age-appropriate way. Plus, it covers other important topics like investing and credit. It’s all part of our Adventures in Math resource center!

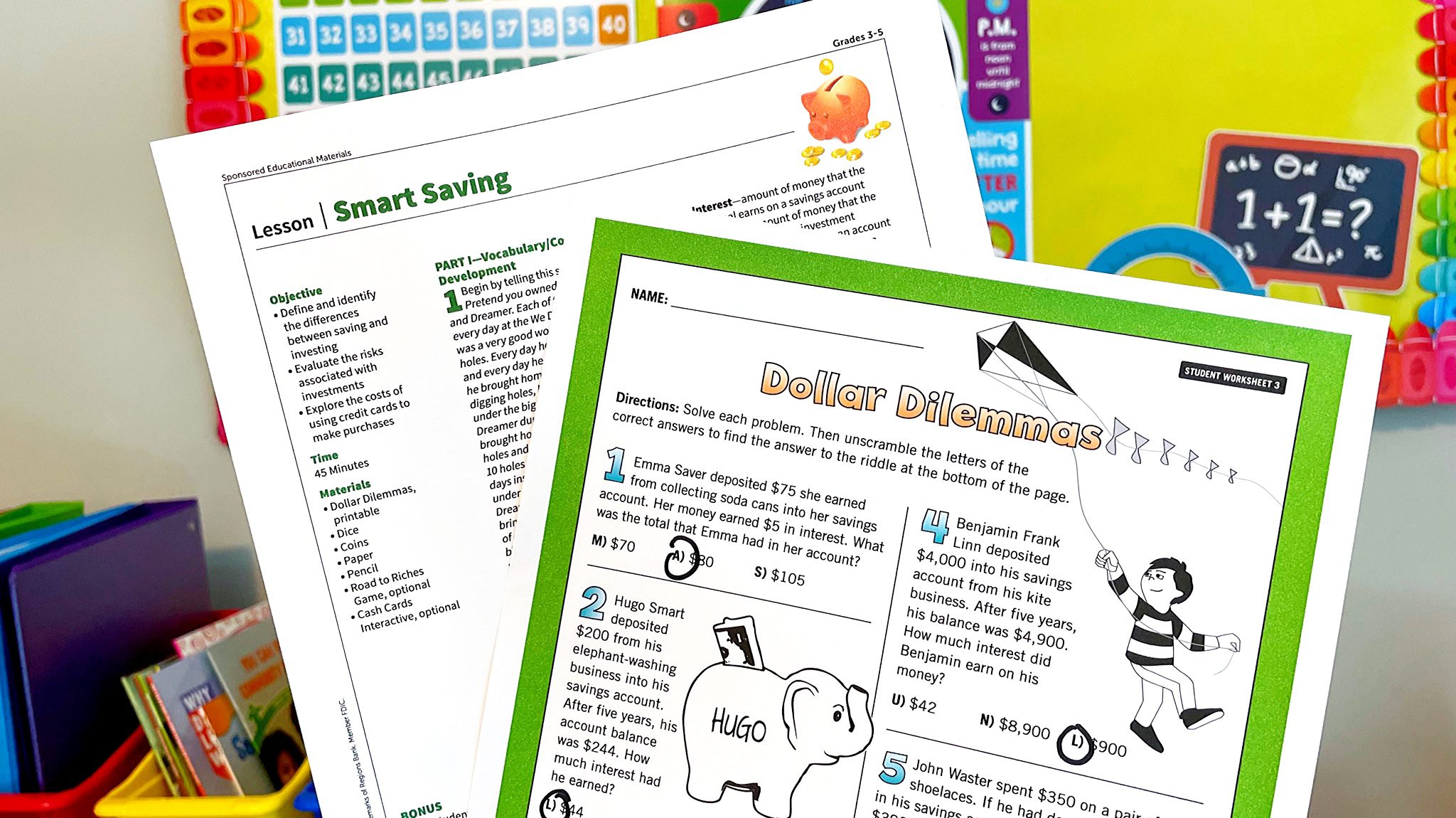

What’s in the “Smart Saving” lesson?

This lesson is divided into four parts:

Part 1—Vocabulary/Concept Development: Tell a cute dog story that’s really an allegory about saving vs. investing to introduce important vocab.

Part 2—Hands-On Activity: Play a dice game to simulate the growth of money in a savings account. A second game contrasts that kind of steady growth with the risks of investing money in a business.

Part 3—Save It or Charge It? Use real examples (buying a new television and computer) to compare the advantages of saving compared with the disadvantages of charging using a credit card.

Part 4—Using Dollar Dilemmas Activity Sheet: Continue the learning around how money can grow when placed into a savings or investment account.

Standards

- Develop an understanding of personal financial literacy, including spending, saving, investments, interest, loans, types of accounts, and account balancing.

- Participate in group discussions.

- Reason abstractly and quantitatively.

- Communicate mathematical ideas, reasoning, and relationships.

- Use place value understanding and properties of operations to perform multi-digit arithmetic.

- Apply mathematics to solve problems arising in everyday life.

- Solve problems using the four operations with whole numbers, fractions, and decimals to hundredths.

- Solve multi-step word problems.

- Analyze information, formulate a plan or strategy, determine a solution, justify the solution, and evaluate the problem-solving process and the solution.

- Represent and interpret data.