In my work helping teachers understand their personal finances, I have often made the mistake of only focusing on the big picture. But simpler things, like reading a teacher paycheck, can be tricky! Most of the time, this isn’t due to a lack of understanding. Random codes and acronyms dotting teachers’ paychecks make them difficult to understand.

So how do you read your paycheck?

First of all, paychecks are different across the country, and even between districts. But they do have similarities. For example, this is a paycheck from an Illinois district. Yours may look similar, or wildly different, but you should experience the same type of deductions on your paycheck.

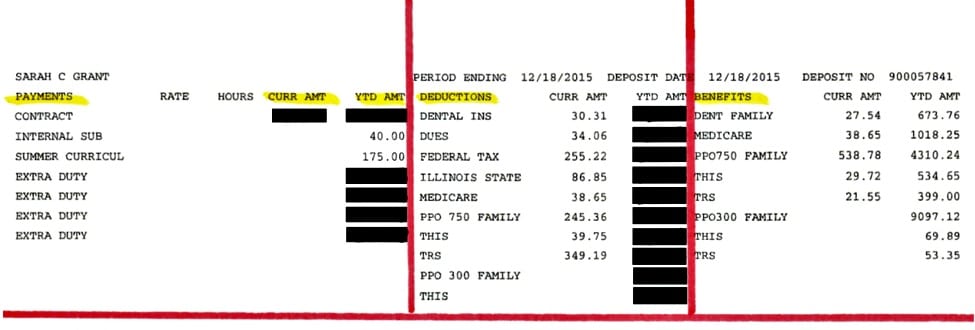

This image is of my wife’s paycheck. It’s been split up into three sections. The first section shows what she’s been paid. Taxes and employee-paid deductions are found in the second section. And the third section shows employer-paid deductions.

As you can see in the first section, this district details all payments that aren’t part of her contract. You can also see the current amount she’s been paid and the amount that she’s been paid year to date. Each pay period you will want to make sure that these numbers are accurate and consistent.

In the middle section, there is a list of deductions that she pays for each pay period. You’ll notice some acronyms near the bottom that relate to the Illinois pension plan (TRS) and her contribution to retiree health insurance for the future (THIS). During this pay period we switched health plans so you’ll see two entries for PPO plans.

You’ll notice in this section that there are no retirement contributions. On your paycheck, this is where you may see a line for your 403b contributions. We save to IRAs outside of our workplace as it’s more cost-effective for us. When you look at this section on your pay stub, you can find out how much you’re contributing to a 403(b). If you make any changes, you should double check that they are accurate.

In the final section, you’ll see employer paid deductions. While it doesn’t have any impact on the overall pay, it’s helpful to see how much an employer pays for coverages and pension plans.

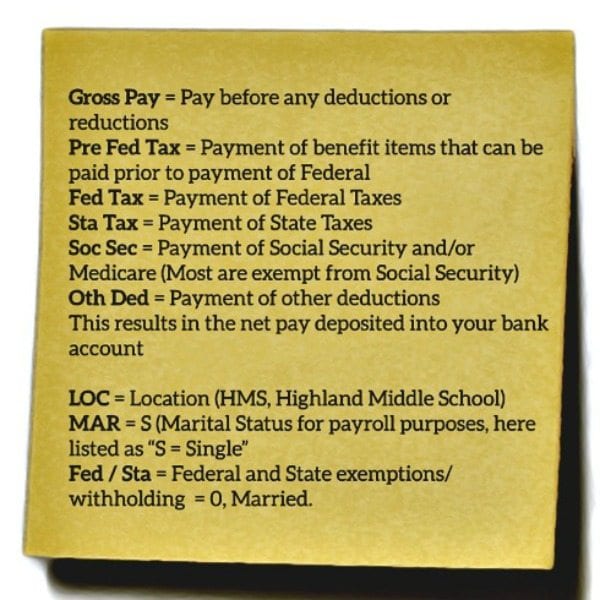

Understand the acronyms on your paycheck.

This chart explains some of the common categories included on a teacher paycheck.

How does your paycheck relate to your financial situation?

It is key that you understand your paycheck so that you can relate it to your financial situation. At the end of each year, you’ll need to gather numbers from your paycheck to provide to your accountant. They will need to know how much you saved to a 403(b), how much you’ve paid in dues and how your exemptions may be adjusted based on your refund or amount of taxes owed.

It is essential to audit your paycheck for accuracy. Sometimes there may be errors on your paycheck. It’s not uncommon to find long-standing errors that a district needs to correct. One of my client’s school districts had a payroll error that persisted two years and was only discovered when a teacher (well-versed in their paycheck and the contract benefits) did a thorough audit. Don’t assume that your teacher paycheck is always correct—be sure to do an audit at least every year to ensure your records are accurate.

Do you have any questions about your teacher paycheck? Please leave them in the comments, and we’ll try to address them in future posts.